nebraska property tax calculator

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. If you buy the property in the middle of.

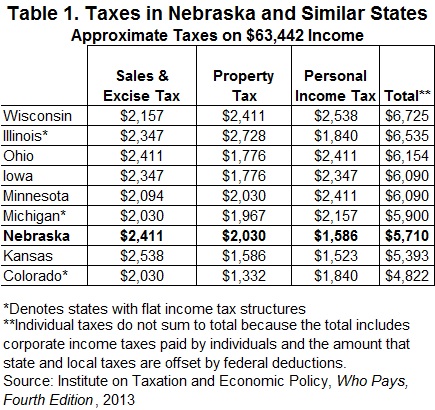

Taxes And Spending In Nebraska

The lowest tax rate is 246 and the highest is 684.

. County AssessorDeputy County Assessor Examination May 12 2022. The Nebraska tax calculator is updated for the 202223 tax year. However local jurisdictions are also able to impose additional sales taxes of 05 1 15 175 or 2.

Nebraska is ranked number seventeen out of the fifty states in order of the average amount of property taxes collected. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Income Tax Credit for School District Taxes Paid Nebraska Property Tax Incentive Act Click here to learn more about this free subscription service as well as sign up for automatic emails when DOR updates information about this program. If you would like more information about Nebraska Taxes Online please contact Joe Power at 888-550-5685.

AP Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool to help them calculate what theyre owed. A convenience fee of 235 100 minimum is included on all payments. Enter the property tax year for which the Nebraska school district property taxes were levied.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. The median property tax on a 10910000 house is 192016 in Nebraska. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions. State tax officials and Gov. Pete Ricketts announced the new online service on Wednesday.

As of 2019 the Nebraska state sales tax rate is 55. So if your. The median property tax on a 10910000 house is 192016 in Nebraska.

Calculations are estimates based on the tax law as of Feb. Use our crypto tax calculator below to determine how much tax you might pay on crypto you sold spent or exchanged. P the principal amount.

The tool helps residents calculate the new refundable income tax credit available this year that allows taxpayers to claim a portion of. Nebraska property tax calculator. AP Nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool to help them calculate what theyre owed.

I your monthly interest rate. To use the calculator just enter your propertys current market value such as a current appraisal or a recent. Form 458L Physicians Certification for Late Homestead Exemption Filing.

The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. If you make 70000 a year living in the region of Nebraska USA you will be taxed 11756.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Lincoln County. For example the 2020 taxes are levied at the end of 2020 and become due on the last day of December 2020. Its a progressive system which means that taxpayers who earn more pay higher taxes.

The median property tax on a 10910000 house is 114555 in the United States. About Your Property Taxes. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

A convenience fee of 100 is included on all e-check payments. Nebraska school district property tax look-up. Nebraskas state income tax system is similar to the federal system.

Sarpy County real estate taxes are levied in arrears. There are four tax brackets in Nevada and they vary based on income level and filing status. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

There are no local income taxes in. They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. This can make your local sales taxes as high as 75.

Nebraska Income Tax Calculator 2021. The Nebraska income tax calculator is designed to provide a salary example with salary deductions made in Nebraska. Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year.

Nebraska launches new site to calculate property tax refund. Application for Transfer of Nebraska Homestead Exemption. Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients.

The median property tax in douglas county nebraska is 2784 per year for a home worth the median value of 141400. The Registration Fees are assessed. 1500 - Registration fee for passenger and leased vehicles.

The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. For comparison the median home value in Nebraska is 12330000.

2022 Reports and Opinions of the Property Tax Administrator. The median property tax on a 10910000 house is 114555 in the united states. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

This tax information is being made available for viewing and for payments via credit card. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle.

Nebraska Property Tax Calculator to calculate the property tax for your home or investment asset.

States With The Highest And Lowest Property Taxes Property Tax States Tax

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

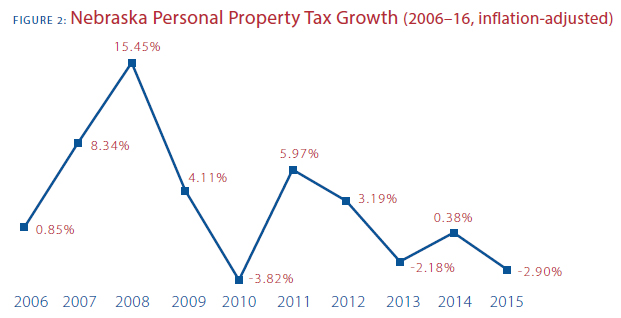

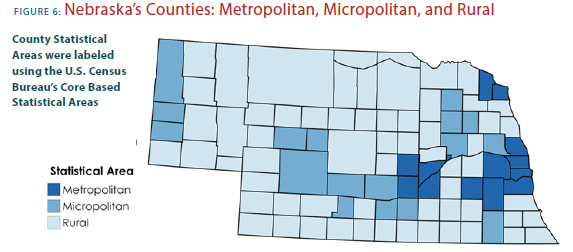

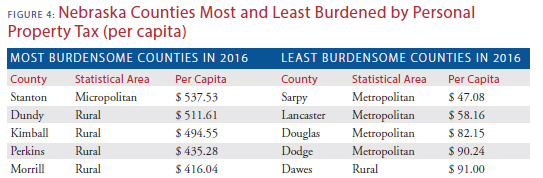

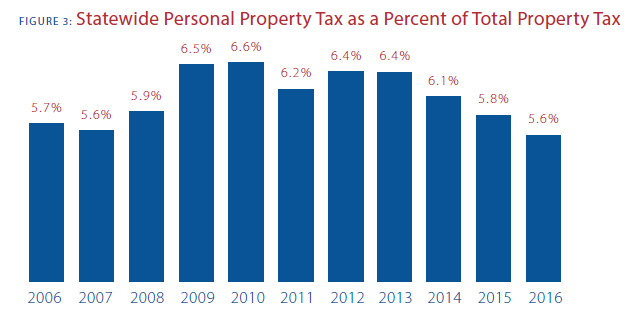

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

Florida Property Tax H R Block

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

This Time It S Personal Nebraska S Personal Property Tax

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Taxes And Spending In Nebraska

New Ag Census Shows Disparities In Property Taxes By State

Nebraska Property Tax Calculator Smartasset

Property Tax Map Tax Foundation

Nebraska Income Tax Calculator Smartasset

This Time It S Personal Nebraska S Personal Property Tax

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Nebraska Property Tax Calculator Smartasset

Compared To Rivals Nebraska Takes More From Taxpayers